This is an evolving web page of resources for local, independent businesses. It's in no way comprehensive, but is intended specifically for local, independent businesses. Thanks to our area partners as we all get updates from each other (Louisville Foward, GLI, SBDC, SBA, etc.) If you have further ideas on what should be included, please email Jennifer.

GLI has led the charge for a hub of information about resources for businesses all over the Louisville area. (LIBA is a partner in the effort along with UofL and Louisville Forward, with design donated by Hatfield Media.) Please explore for more information. And an especially handy feature for our small businesses - the ability to ask questions specific to your business, that will be answered by one of the partners.

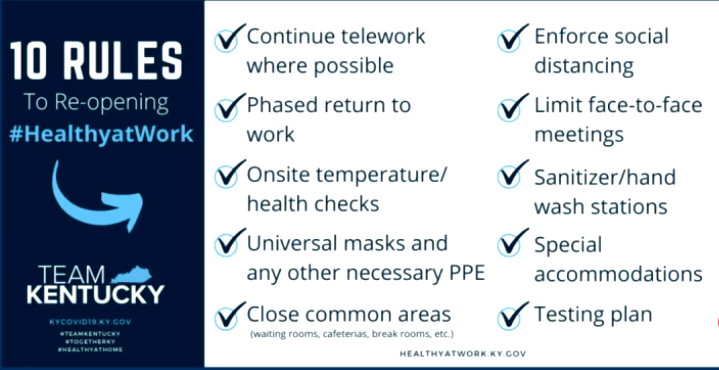

REOPENING INFORMATION

Visit the Kentucky Healthy At Work website

PPE Sources For Reopening - We've

started a list of LIBA members offering PPE, such as facemasks, plexiglass

dividers, etc. You can download it here. If you're company offers it, please email Leslie. We also have a

resource in the Crisis Support Hub to access other

vendors who are providing PPE. (We'll add any members we hear of to that list.)

If you have difficulty acquiring PPE from this site or if you need PPE sooner

than what is possible for the suppliers, you can contact GLI's Deana Epperly Karem. They

are securing some PPE for purchase by small businesses.

Reopening Water Quality: Louisville

Water is asking businesses to safely resume operations as workers

return to businesses that have been empty or under used. Properly flushing

plumbing is an essential part of that safe, re-opening strategy. After

water flows through the meter, building owners are responsible for maintaining

water quality. Louisville Water has created a step-by-step guide to help

business owners understand how to flush the internal plumbing. Learn how to do

that here.

FEDERAL GOVERNMENT UPDATES

The CARES Act includes programs available for small businesses – Paycheck

Protection Program, Emergency Grants, etc. Thanks to Louisville Forward for this translation of the bill for small businesses (also

includes example scenarios). On April 24th another round of funding was passed. MORE INFORMATION BELOW in the Finances/Funding Section.

The first bill was an $8 billion emergency response package, which

dedicated money to state, local, national, and international institutions to

prevent and combat coronavirus and to develop a vaccine; the second bill ensured free coronavirus

testing, established a federal emergency sick leave program for up to three

months at 2/3 pay, for workers with coronavirus whose companies do not already

have paid sick leave, with the exception of businesses under 50; it also gave

$1 billion to states for unemployment insurance, and $1 billion for nutrition

assistance.

EDUCATIONAL RESOURCES

UPCOMING WEBINARS:

Mayor Greg

Fischer's Town Hall on Reopening - Tue. 5/12, 10am via Facebook Live

The Mayor

will be joined by Dr. Sarah Moyer and local businesses to share information

about reopening. Join by visiting the Mayor's Facebook page at event time.

RECENT WEBINAR RECORDINGS:

LIBA Town Hall on 5/5: Preparing For Reopening - Click here to view and use the password 6w#7E1mC

Further Clarification on PPP Loan Forgiveness - Second in a

series presented by SBDC on 5/6, access the recording here.

PPP Loan

Forgiveness Webinar (4/28) SBDC hosted

this webinar: link to replay video and a PDF of materials. If you would like additional

assistance, you may contact a Kentucky SBDC business coach by calling

1-888-475-7232 or by visiting http://KyBizHelp.com.

Client Relations and Marketing During the Pandemic (4/15) - We had our first 'regular' member event online yesterday, and the content was exactly suited for our independent business owners. If you missed it, don't fret - you can view the recording here. (Access Password: i4%9#N+0) Thanks to our panelists for the fun, valuable and practical information: Jason Clark (VIA Studio), Ashley Parker (Parker & Klein) and Natalie Villareal (Mahonia) - and moderator Adam Robinson (Villepreneurs).

Resources for Independent Businesses (4/6) - Find a recording of the webinar here and a 'transcript' of the questions with their answers that could be helpful (whether you attended or not). We added a few answers that we didn't get to during the call. (NOTE: For those on the call or viewing the recording, one of the statements was incorrect - for the PPP loan, 1099 employees do not count in your total payroll. 1099 folks can apply on their own for the PPP in phase 2, those applications will be accepted starting April 10.)

LIBA TOWN HALL (3/30) - addressing disaster loans, forgivable $10k advance, unemployment, etc. Watch the session here.

- SBA/SBDC - Disaster Loan How To's (3/23)

- HR Crisis Management for Coronavirus: Answers to Tough Questions (3/23, link to slides)

- Indie Biz During COVID-19/Sharing LIBA Resources (3/17)

REMINDING THE PUBLIC

DIRECTORY: Our membership directory has been modified to include special info relevant during this time (delivery, online ordering, etc.). We are also including links to other area resources, we're all in this together! Please visit the directory here. (And if you are a member needing to add your information, please log in and do so. Email Leslie if you need help, or just send along your info and we'll get it in there.)

SOCIAL MEDIA: We developed the following social media graphics that can be shared. You can download the graphic HERE and HERE and we encourage you to share, share, share. Tag your posts with #StayHome and #KeepLouisvilleWeird. We want people to stay safe while supporting their local businesses!

MARKETING YOUR OWN BUSINESS: During these unprecedented times when “social distancing” is

a term as often used as “social media”, businesses are having to get creative

to keep their customers engaged and their businesses relevant. So marketers and

businesses owners are turning to their social media pages to share how their

adjusting during the COVID-19 pandemic, specifically on Facebook

Live and Instagram. To help support our members during this time,

our Branding

Committee (Lauren Hendricks and Tori Thompson) created a list of best practices for producing your own DIY videos for

social media. Stay connected through video, and let followers see your world,

even if they can't see you in person. Remember to have fun with video and be

yourself! Download the tip sheet. (Social

Media Today has published an article about the recent updates Facebook has made

to Facebook Live. Click here to read

the full article.)

EXPAND YOUR AUDIENCE - LIBA will post your promotion to our social media audiences, email Leslie your promotion/images.

AMERICAN EXPRESS has shared a Shop Small graphic and some sample social media posts you can use during the pandemic.

5 TIPS FOR BUSINESSES NEW TO E-COMMERCE - Adding e-commerce options? Selling gift cards? Here are some straightfoward pointers to bring your online sales up to speed. Thanks to our friends at Stay Local! New Orleans for these quick tips we wanted to share. Read the full blog post here.

- It’ll be easier to build an E-Commerce store than tack it onto your existing shop -- using Shopify or Square’s Online Store platforms right now is faster than you think.

- Ensure that the checkout process is simple. Only ask for the information you need.

- Free or reduced-cost delivery/shipping plays a huge role in whether a customer decides to purchase or not, and keeps you competitive with others.

- Provide the customer with an incentive for a future purchase.

- Emphasize how much their purchase helps our local community.

FINANCES/FUNDING SOURCES FOR BUSINESS

>SBA’s Economic Injury Disaster Loan

(EIDL) Program:

Apply here. These loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact. The interest rate is 3.75% for small businesses. The interest rate for non-profits is 2.75%. APPLYING for a disaster loan does not preclude you from receiving relief from other programs, and you don't have to accept the loan once it's offered.

- Here are some slides from the SBDC that include the site's form so you can gather your info in advance. The information asked for is very straightforward.

- You do not have to take the loan to still get the $10k grant, but you do need to go through the application process. We learned that as of 4/8, it is not an automatic $10,000 but rather based on the number of employees for businesses with fewer than 11 employees: $1,000 per employee with a maximum cash advance of $10,000. If you applied as a sole proprietor, self-employed individual or an independent contractor and did not list any employees in you application, the portal will assume 1 employee for the business owner when calculating the advance eligibility.

- Payroll Protection Program loans (that become grants) are separate from this disaster loan/grant program and are applied for through banks, not the SBA. (See below.) If you receive an EIDL cash advance prior to the disbursement of the PPP loan, the EIDL advance may be deducted from the total of the PPP loan approval.

The help number is 800-659-2955 (open weekends too, 8am-8pm) or e-mail disastercustomerservice@sba.gov. (You can also request help in other languages or for hard of hearing). (Sharia Loans - Our understanding is that in our Muslim communities fees are acceptable but interest is not. SBA is still recommending to apply for the disaster loan, and hopefully there can be special arrangements made when the loan is processed.)

>CARES Act/Paycheck Protection Program:

In addition to the disaster loans, you can also apply for the Paycheck Protection Program. A simple translation of the Act (pertinent to small business) is here, and you can see your options below. (ALSO - see the SBDC webinar - link to replay video and a PDF of materials.)

>More about the Paycheck Protection Program:

This program has reopened with additional funds as of 4/27. It offers small business owners an opportunity of relief from the crisis

at hand. If you plan to apply, we recommend you do it quickly as funds are still expected to run out. Small businesses and eligible nonprofit organizations,

Veterans organizations, and Tribal businesses described in the Small Business

Act, as well as individuals who are self-employed or are independent

contractors, are eligible if they also meet program size standards.

The Paycheck Protection Program is a

provision of the Coronavirus Aid, Relief and Economic Security (CARES) Act, a

$2 trillion emergency fiscal stimulus package with the aim of mitigating the

economic damage created by the Coronavirus pandemic.

Specifically, the Paycheck Protection Program provides small businesses with

funds to pay up to 8 weeks of payroll costs including benefits.

Funds are provided in the form of loans that will be fully forgiven when used

for payroll costs, interest on mortgages, rent, and utilities (due to likely

high subscription, at least 75% of the forgiven amount must have been used for

payroll). Loan payments will also be deferred for six months. No collateral or

personal guarantees are required. Neither the government nor lenders will

charge small businesses any fees. Here’s a list of banks in the area that are already SBA

certified.

If

I get an EIDL and/or an Emergency Economic Injury Grant, can I get a PPP loan?

Whether

you’ve already received an EIDL unrelated to COVID-19 or you receive a COVID-19

related EIDL and/or Emergency Grant between January 31, 2020 and June 30, 2020,

you may also apply for a PPP loan. If you ultimately receive a PPP loan or

refinance an EIDL into a PPP loan, any advance amount received under the

Emergency Economic Injury Grant Program would be subtracted from the amount

forgiven in the PPP. However, you cannot use your EIDL for the same purpose as

your PPP loan. For example, if you use your EIDL to cover payroll for certain

workers in April, you cannot use PPP for payroll for those same workers in

April, although you could use it for payroll in March or for different workers

in April.

How

does the PPP loan coordinate with SBA’s existing loans?

Borrowers may apply for PPP loans and other

SBA financial assistance, including Economic Injury Disaster Loans (EIDLs),

7(a) loans, 504 loans, and microloans, and also receive investment capital from

Small Business Investment Corporations (SBICs). However, you cannot use your

PPP loan for the same purpose as your other SBA loan(s). For example, if you

use your PPP to cover payroll for the 8-week covered period, you cannot use a

different SBA loan product for payroll for those

>Small Business Continuity Loan Program

Announced on 3/31 by Mayor Fischer, this loan is for businesses with 10 or fewer FULL TIME employees (part time employees not included in the calculation at all), has zero interest and no payments for 12 months. More info here. The applications are now open: https://www.lhomeky.org/

>SBA

Express Bridge Loans (for those who already have a business relationship with an SBA Express Lender)

Express Bridge Loan Pilot

Program allows small businesses who currently have a

business relationship with an SBA Express Lender to access up to $25,000

quickly. These loans can provide vital economic support to small businesses to

help overcome the temporary loss of revenue they are experiencing and can be a

term loans or used to bridge the gap while applying for a direct SBA Economic Injury Disaster loan. If a small

business has an urgent need for cash while waiting for decision and

disbursement on an Economic Injury Disaster Loan, they may qualify for an SBA Express Disaster Bridge Loan.

Click here for more information

>Local banks and credit unions response

Bank on Louisville has gathered information about how local banks and credit unions are supporting customers impacted by the COVID-19 crisis. Please contact your financial institution to learn more about these relief efforts and discuss your individual eligibility. You will need to contact your bank or credit union to participate in relief programs as they are not automatic.

>METCO:

The city’s

small business loan program has implemented some temporary relief for current

loan holders:

- ·

No

late fees will be implemented for three months

- ·

Loans

will be extended three months

Loan programs assist with start-up capital, working capital, capital

improvements to commercial and public properties, and helps low- and moderate-income

individuals start or grow a business. For more information about the METCO loan

program or small business resources, visit www.louisvilleky.gov/smallbusiness

>Micro Loans:

Obtaining

capital to start or expand a business can sometimes be the biggest barrier for

our low to moderate income individuals. Loans are available up to $10,000. Loans are available

from:

Jewish Family

& Career Services – http://navigatecenter.org

Community

Ventures – http://www.cvky.org

LHOME – https://www.louisvillecdfi.org/

>KIVA:

Expanded 0% loan options. And here's an actual person right here in Louisville to reach out to! Email Vanessa Koenigsmark with Access Ventures/Render Capital, who have been Kiva champions for Louisville. Effective

immediately, U.S. applicants for a Kiva loan will have access to the following:

1.

Expanded eligibility: More

businesses in the US will be eligible for a Kiva loan than ever.

2.

Larger loans: The

maximum loan on the Kiva platform will increase from $10,000 to $15,000. NEW as of 3/27: In addition to offering 0% interest, no-fee loans, we’re implementing a 6-month grace period, a $15,000 loan maximum and expanded eligibility.

3.

Grace period: New

borrowers may access a grace period of up to 6 months for greater financial

flexibility.

If

you’re a small business owner who believes you can benefit from a Kiva loan, or

you know one in your community, go to www.kiva.org/borrow to

apply for a loan. Here are some recent FAQs.

>Vogt Awards - Early-stage businesses can apply to win $25,000 plus lean startup education and mentorship through the 20th annual Community Foundation of Louisville’s Vogt Awards. More info here.

> Consider

Employee Ownership? This is an informative webinar

about possible ways to use employee ownership or conversion to a worker-owned

co-op as methods to finance a small business: Worker Co-op Conversions During Covid-19. The first

half is basic, but the second part specifically goes over the different ways to

do it, including how to do a conversion on a much shorter than normal

time-frame.

>POTENTIAL FUNDS/GRANT (particularly for women & minority owned businesses)

Shea Moisture Fund - app deadline April 15 but may reopen

Facebook Grants for Small Business (30,000 over 30 countries - chances seem slim, but hard to say!)

Verizon Small Business Recovery Fund

US Chamber of Commerce Foundation (for underserved zip codes)

SPANX Foundation for

female entrepreneurs Red Backpack Fund - You have to apply during certain windows but they

give you the dates and details and you can sign up for an email reminder:

Salesforce Grants - Salesforce

Care Small Business Grants of $10,000 are available beginning Monday, April 27

for companies with 2-50 employees and annual revenues between $250k and $2M

which have been in business 2 years. Read FAQ here or visit grants.ureeka.biz for

application details.

This is an article from Forbes and has a list of

different grants with details: https://www.forbes.com/sites/briannegarrett/2020/03/20/small-business-relief-tracker-funding-grants-and-resources-for-business-owners-grappling-with-coronavirus/#69a946f8dd4c

A few more grants that might be helpful for the non-profits,

some of them are seen on the Forbes list also: https://www.globalgiving.org/learn/covid-19-grants

>Federal and State and Local tax deadline postponed from April 15 to July 15. (More local info: Louisville Metro Revenue Commission (LMRC) will extend the 2019 annual occupational license tax filing and payment deadline from April 15, 2020 to July 15, 2020. The extension is for all taxpayers, including those who filed quarterly estimated deposits in 2019 and those who pay once a year. LMRC also has shifted the April 15, 2020 quarterly deposit deadline to May 15, 2020 for entities required to file a quarterly estimated payment. All other LMRC deadlines will remain in place.)

EMPLOYEES/SUPPORT

Summary of the Families First Coronavirus Relief Package:

that became effective April 2. For businesses with under 500 employees, this requires paid sick time (related to Coronavirus) that will be subsidized by the government by giving credits towards Social Security taxes owed by the business.(Businesses with under 50 employees can request waivers.) The bill also ensures testing for the Coronavirus will be at no cost for all.

The new guidance (3/27) includes two posters – one for federal

workers (en Espanol) and one for all other

employees (en Espanol) – that will fulfill notice requirements for employers obligated

to inform employees about their rights under the new law. In addition,

the WHD released a questions

and answers document about posting requirements, as well as a Field

Assistance Bulletin describing WHD’s 30-day non-enforcement policy. More resources around the new

HEALTH INSURANCE

MEDICAID (KENTUCKY): For those who have been left without health insurance, there have been changes in Kentucky to expedite the process of signing up for Medicaid through "Presumptive Eligibility." First, this form needs to be completed for EACH person that is in need of insurance (i.e. if you have you, your spouse and a child, and the child is already covered by Medicaid, then you must complete a form for you and your spouse). In the household section, you will need to list ALL members of your family (for this example, including the child that is already covered by Medicaid).

Presumptive Eligibility only gives coverage through JUNE 30, 2020. Once your information is confirmed for eligibility you will be assigned to a Managed Care Organization (ie. Passport or others) and sent an ID card. (If you want to change your MCO you can call Benefind and asked to be switched to the MCO of your choice.)

To continue coverage you MUST complete an application to apply for Medicaid. You can do this via the following ways: 1) On-line through Benefind.ky.gov 2) By calling Benefind at 1-844-407-8398 or 3) By contacting an Assister (see this list).

ECONOMIC IMPACT PAYMENTS FOR INDIVIDUALS

Many have started receiving their stimulus money, automatically deposited in their bank accounts. For individuals who don’t have a bank or credit union account on file with the IRS, register it now (otherwise you may be waiting months for a paper check). Sign up with your bank account number at this IRS’ webpage https://www.irs.gov/coronavirus-tax-relief-and-economic-impact-payments. For more FAQ's on the program, visit this page. Be on the lookout for scams! Some common ones expected here.

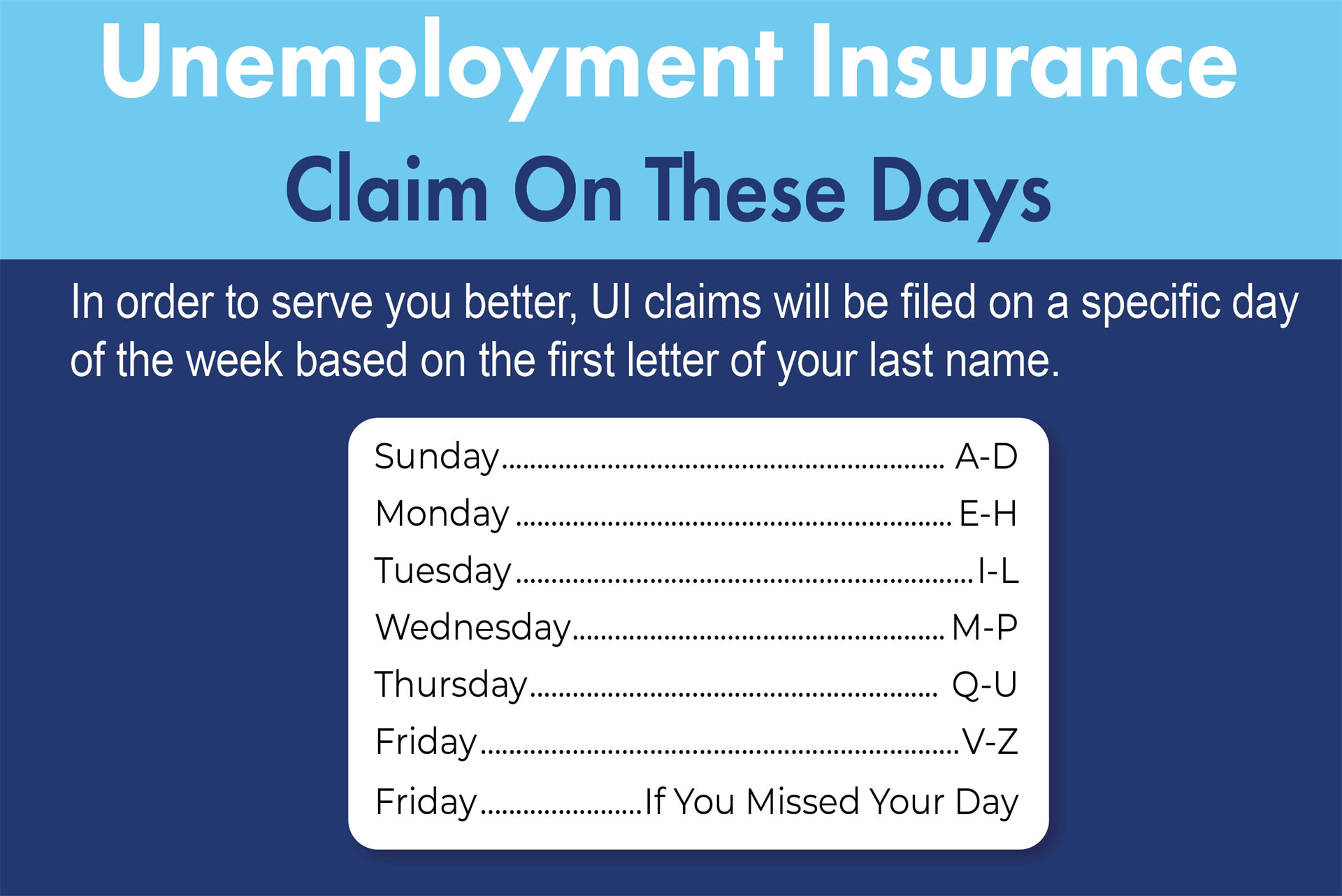

STATE UNEMPLOYMENT

Kentucky: The Kentucky Career Center released an updated FAQ (for employees and employers) about unemployment during the pandemic. They will consider it temporary job loss, similar to if an employer has to have a shut down. The state is also waiving the seven-day wait period of requesting unemployment benefits, and the job search requirement. To apply for unemployment insurance, visit the Kentucky Career Center’s unemployment benefits page at https://kcc.ky.gov or call 502-875-0442. But first, check the schedule.

A more comprehensive resource can be found through our friends at GLI's Unemployment FAQ website (ALONG WITH INDIANA RESOURCES) and a calculator of benefits is here.

We’ve received a lot of questions about unemployment – from

employers and the self employed.

EMPLOYERS: Some businesses are afraid their laid off

employees will opt to stay on unemployment rather than come back to work when

this is over. It’s true that once you have signed off that your employee is

laid off, there is no other communication that Kentucky will prompt you for. Hopefully

your employees are committed and you have had open conversations with them

about this! In addition, once you are ready to extend an offer of re-employment,

we suggest you give as much advance notice as possible of the recall date and

follow up any verbal return to work/recall notice with a written letter or email.

Then keep the email/letter to the recall. The employer could report any refusal

to the KY Office of Employment and Training, who would in turn contact the

former employee to investigate. The employee may be allowed to stay on UI if

they can cite a bona fide reason for refusing suitable work—ex. safety or still

taking care of someone with COVID-19 complications, etc.

SELF EMPLOYED AND SMALL BUSINESS OWNERS – hopefully this will help you

know what to expect:

1. For those that are self employed your application will

continue to say insufficient wages until they update their system and

automatically validate your application. You do not need to refile at this

point, even if rejected.

2. The first check will automatically be sent out to whatever

payment method you put in the system. You do not have to do anything other than

file your original claim to receive that. You will receive pay from the date

you first put in your claim. The amount is dependent on your income, anywhere

from $39-$552 a week. (Benefit calculator with a FAQ on CARES Act payments.

Example gives weekly amounts, but normally it’s paid bi-weekly. http://apps.kcc.ky.gov/career/WuiCalculator.aspx.)

3. In order to receive the next check 2 weeks later you will

have to go in the system and request it.

4. A second separate payment of $600 from the federal

government will be deposited directly. As of today (4/9), Kentucky has received what it needs to start payments and is beginning immediately.

1099/Contractors/Freelancers/Small Business Owners, etc. are able to apply for unemployment.

OTHER RESOURCES:

Is someone you know looking a new job or career? Kentuckiana Works can help during this challenging time by offering a variety of virtual career services, including online workshops and 1-on-1 coaching. All of their services are free of charge.

GLI Job Match Program: While we recognize that many businesses are negatively affected by the changes implemented from COVID-19, we also know that some businesses are needing to scale up their workforce. If you are a business that is scaling up your workforce, or if you’re an employer who needs to scale back, GLI wants to help make those connections. Click the link to email if you are looking for work or needing workers, the number of people you are looking for, specialized skills you require, and your contact information.

One Louisville: COVID-19 Response Fund - The One Louisville: COVID-19 Response Fund will provide support for families impacted by COVID-19. Download the flyer here.

The Team Kentucky

Fund has been established, residents of the Commonwealth can make tax

deductible donations to help residents who have lost income during

COVID-19. To make your donation, click here. (Application processes to come.)

General Human Services (food, etc.) - https://louisvilleky.gov/government/resilience-and-community-services/seeking-services

Local Gig Workers

Relief – led by Lance Minnis - https://www.gofundme.com/f/gig-worker-food-bank-fund

Local

Musicians – led by

Carly Johnson - https://www.gofundme.com/f/with-a-little-hope-from-my-friends

Restaurant

Worker Relief Fund: The LEE Initiative and Makers Mark are

providing free carry-out, heat-and-serve meals to restaurant workers

with pay stubs to prove their employment. Workers can pick up the

meals (limit 2 per person) at 610 W. Magnolia Ave., from 5

to 8:30 p.m. They are also stocking family necessities for babies and

children, non-perishable canned foods, toilet tissue and

Tylenol. Everything is on a first-come, first-serve basis. Donate at www.leeinitiative.org or

for more information.

Rye is offering free meal pick up for restaurant workers who are out of work.

Apron Inc

Emergency Fund for Restaurant Workers: A $10,000 emergency

fund specific for COVID-19 affected businesses and employees, and Apron will be

distributing $400 grants to eligible applicants. To be eligible

for a grant a person must:

- ·

Be

diagnosed with the COVID-19 virus (Apron will require a doctor’s letter).

- ·

Be

employed in an independent restaurant at least six months.

- ·

Be

able to produce bills to be paid (Apron does not give money directly to

grantees).

Apply at http://www.aproninc.org/application/

Bartender Emergeny Assistance Program - The U.S. Bartenders Guild is offering eligible bartenders grants to help with expenses. Bartenders do not have to be members of the Guild to apply.

Artists - ELEVATOR

Artist Resource is leading the new Artist Relief Trust, a coalition-led initiative

working to provide emergency assistance to artists in need who have lost work

due to Coronavirus/COVID-19 related closures & cancellations.

Meals for those age 60+: https://louisvilleky.gov/government/resilience-and-community-services

Breakfast/Lunch for those under 18: Jefferson County Public Schools is offering free breakfast and lunch to children and teens at more than 58 sites in response to COVID-19. The sites will be open from 10 a.m. to 1 p.m. weekdays. Map of sites | List of sites

Utilities/Rent - Louisville Water Company and LG&E will not be turning off service for nonpayment. Evictions are also not taking place while courts are closed.

OPERATIONS/LOGISTICS

If you're unsure at what level your business is allowed to remain open after yesterday's Kentucky executive orders, you are supposed to be able to call 833-KY-SAFER (833-597-2337) to clarify. (Let us know your results!) All in-person retail

businesses that are not life sustaining are now closed (though they can still

fill phone and online orders through curbside services or delivery). A full

list of categories of life-sustaining, in-person retail businesses is attached

to the order.

Essential Businesses Who Are Open - Here's a one page resource guide from our friends at Louisville Forward to so you can stay in compliance with guidelines.

Hand Sanitizer Request Form - #TeamKentucky is working to prioritize requests for hand sanitizer with distillers and other companies that are rushing to obtain and produce the necessary products. Please complete this form so we can process and prioritize your request. Note: Hospitals, first responders and other critical employers are receiving top priority.

Another resource for hand sanitizer - Visit this page to request small hand sanitizers with free shipping. The supply will be prioritized: hospitals, then elderly homes/first responders, then non profits, then households and businesses. Limits are 30 bottles for business and 10 for individuals households.

State Guidance for Home-Based Processors

State Guidance for Farmer's Markets

Building Trust In Trying Times - Tips for business owners during the Covid-19 pandemic from the Better Business Bureau.

For essential businesses that are open, here are signs for your doors from the health department in English and Spanish.

PARC - To support

restaurants and accommodate those who are picking up carry-out orders and gift

cards, the parking authority is allowing free parking at meters adjacent to

restaurants for up to 15 minutes. Cars must use their flashers. Visit https://louisvilleky.gov/government/parking-authority-parc

Package liquor sales - Kentucky restaurants can temporarily sell package liquors to go.

Business

Liability Insurance - Check with your insurance carrier about any benefits you may have from

disruption due to acts of God.

Centers for

Disease Control and Prevention (CDC) - The CDC also

offers resources for business and employers on how to respond to the COVID-19

pandemic in accordance with guidance from health professionals. Visit https://www.cdc.gov/coronavirus/2019-ncov/community/organizations/businesses-employers.html

SCORE Online Support

Is Available:

Local Workshops. Visit our Workshop Calendar to find Webinars

available to you at this time. Please follow this link to see the calendar and

register for upcoming webinars: https://louisville.score.org/content/take-workshop-277

Mentoring Sessions. Mentors are available to participate in

remote mentoring sessions via phone, email and video. If you already have a

SCORE mentor, ask them if you can use a remote mentoring method for your

sessions. If you don’t already have a mentor, you can find a business mentor today.

Libraries: While libraries are closed, the Ask A Librarian resource is still available.

Remember all your library free resources - Right now would be a great time to get reacquainted with the Louisville Free Public Library's digital resources. LFPL offers access to eBooks, eMagazines, downloadable audiobooks, streaming music and movies, and online courses - 24 hours a day, seven days a week with a Library Card. See all the resources in one place at http://www.lfpl.org/digital.html. If someone doesn't have an LFPL library card, don't fret! People can now get one online at http://www.lfpl.org/get-card.htm.

AND Online Training Videos - Lynda.com, a premier online learning resource offering more than 4000 courses covering technical skills, creative techniques, business strategies & more is available for FREE to all LFPL library card holders. Get instruction in everything from 3D animation and photography to Adobe Creative Suite and Microsoft Office. Start learning online today at http://lfpl.org/lynda.

BUSINESSES HELPING BUSINESSES

If you have any resources related to PPEs (Personal Protection Equipment) such as surgical masks, personal protective gowns, face shields, eye protection,

and hand sanitizer - be it the capability to manufacture or anything in stock - please contact us.

Facilities Management Services (FMS) is offering COVID-19 preventative sanitization and COVID-19 exposure cleaning per CDC guidelines. We are proud to be a part of Team Kentucky since 1999. For more details, email sales@fmspbc.com or click the link.

FROM MODUET (LIBA member):

Free website edits related to the recent coronavirus pandemic. We do not want anyone’s resources to be limited during this

intense time. Any individual, company or non-profit is encouraged to reach out

and take advantage of this resource. You can utilize free website edits to:

- Add an announcement related to

the pandemic

- Update an existing page

- Add a payment gateway to accept

donations

- Add a shopping cart to sell

gift cards

- Setup a contact form

If you, your

organization or someone you know needs help making an update to their website

in order to continue to do business as a result of the coronavirus, reach out to our

team and we can help.

FROM EM GLOBAL GROUP (LIBA Member):

We are offering a free business consultant via Zoom to everyone that has been effected by COVID-19. This consult will provide you with advice on how to utilize your current business assets to help generate income into your business. We have helped several businesses get online and start selling right away. Contact Jeremy.

FROM SQUARE:

* Square

Online Store launched the ability for any business to accept online

orders for curbside

pickup or local

delivery. The monthly fees for these features are waived through June

30, 2020. You can view tutorial

videos to help you get set up online.

* We are refunding all

software subscription fees

for the month of March, which includes Square Appointments, Retail,

Restaurants, Loyalty, Team Management, Payroll, Marketing, and Square Online

Store. Square will manage the process for you—there’s no need to do anything.

* We’re also offering a resource

hub with information and advice for businesses to navigate this new

environment, which covers how to offer local delivery, set up and promote electronic

gift cards, utilize free marketing campaigns, turn

off signature requirements for in-person purchases, and more.

DELIVERY SERVICES:

Several large delivery vendors are making temporary changes to help support small businesses. Postmates and GrubHub have both announced that they will suspend commission fees for independent restaurants during the crisis. Restaurants must sign up for the relief pilot program for Postmates. UberEats is waiving their delivery fees for independent restaurants.

FROM PHOENIX IT (LIBA member):

We would like to take a moment and offer our help to any business that needs help in letting their employees work from home. We will be giving a free 30 days trial on our monitoring/antivirus software for anyone who needs it. This includes our remote software that will give you the ability to connect to you computer at work from home. We at Phoenix-IT know that this will be a difficult time for the small business community and want to help in anyway we can. Please do not hesitate to contact us for any technology questions. We are here to help! Jeff@PhnxIT.com, 502-473-5502

FROM HELLO SPOKE (LIBA member):

We added a

temporary service for any company that needs a fast and easy solution to make

and take phone calls from anywhere/home. They can cancel at any time, so this

is really to help companies get through this uncertain time. The second offer

is for our regular business phone service with 4 options to make/take calls

from home, and we are offering free set-up for all LIBA members. Jamie Webb, 888-955-5155 x130, JWebb@hellospoke.com.

FROM Louisville Startup Mentors:

These mentors and subject matter experts (SMEs) have a wide range of experience as entrepreneurs and business leaders. We can help you with ideation, market validation, raising capital, marketing, business development, operations, accounting, tech, and much more. Offering at least 1 hour of free consultation.

FROM TILFORD, DOBBINS & SCHMIDT, PLLC (LIBA Member):

Over 100 year old law firm offering 30-60 minute complimentary consultations to LIBA members on everything from employment law to taxation to planning. Email Patrick for more information.

FROM UNIVERSITY OF LOUISVILLE (LIBA Member):

The University of Louisville’s College of Business is offering its expertise to help the business community during the COVID-19 pandemic. Every Friday afternoon, any entrepreneur or small business owner in the Louisville area can schedule a free online meeting with Suzanne Bergmeister, assistant director of the Forcht Center for Entrepreneurship. Appointments are available from 2:00 – 4:00 p.m. on Fridays.

FROM FAUVER LAW OFFICE (LIBA Member): In light of the Covid 19 crisis, if any of you, and I hope there

is not anyone, has to file for personal or business bankruptcy, I will give you

a discount. Just let me know you are a LIBA member. This discount will stay in

place for three months following the normal resumption of business. shannon@fauverlaw.com

New From SBDC! COACH CONNECT

This is a simple page where people can book time with any of the SBDC team

without going through scheduling phone calls and emails. Check it out.

WORKING THROUGH THE CRISIS

WORKING FROM HOME

Free conference call services -

Zoom

GoToMeeting

Join.Me

Skype

Other Resources -

From member Excavive - Working from Home: 21 Tips for Effective Productivity, Leading with Compassion and Excavating Peace & Serenity

Psychology Today: 5 Tips for Working From Home During COVID-19

Staff.com: Remote Work Benefits, Obstacles, and Best Practices

Harvard Review: 15 Questions About Remote Work

TAKE CARE OF YOURSELF: During this critical

time, it’s important that we not only take care of ourselves physically, but

also emotionally. The news can be frightening and the future seems uncertain at

the moment, so it’s critically important that we take some down time to help

our emotional states adjust. First, getting plenty of rest and eating well will

help us maintain both our physical and emotional well-being. But it’s also

important to unplug from the news every so often and take a break to exercise

at home by taking a walk (while practicing recommended social distancing),

spending time with your family or reading a book. This crisis won’t last

forever, and it’s important that we stay emotionally strong for ourselves, our

families and our community.

TIPS FROM OUR FRIENDS AT THE UOFL FAMILY BUSINESS CENTER:

What works for leaders in times of crisis?

- Anxiety is contagious. Be aware that you can help contain and manage anxiety with your own behavior.

- Lean into your strengths. Family businesses have a tested resiliency and the ability to recover from challenges. Keep this in mind every day.

- Look to the past for guidance. What other challenges have you overcome? Tell those stories to remind others that together, we will work our way through this.

- Show commitment to your people. Your employees look to you for strength and guidance. You demonstrate prudence in your actions and language. Lead with calm.

- Work together. Focus on the health and well-being of your people and your communities. Monitor those around you.

- Lead with intention. Respond rather than react. Responding requires us to slow ourselves down and work with our family and leadership team toward common goals.

- Continue to be financially responsible. Most family businesses exhibit a conservative use of debt, making them uniquely positioned to ride out a crisis.

- Focus on what is within your control and what is in front of you. You live with three spheres: what you can control, what you can influence, and what is beyond your control and influence. You can only influence the first two realms, thus try not to stress so much about what you cannot control or influence.

- Be purposeful. Decide where to put your time and effort. You can choose to focus on the 24 hour news noise which adds to your anxiety. You can also choose to focus on your personal support system—sleep, regular meals, prayer, meditation, humor, and your plan for the day. Make the conscious choice to focus on the actions that will support the work you need to do.

Best Practices from Family Business around the World:

- Set up a “crisis room” with regular senior leadership team meetings (virtually or in person) for morning and evening check-ins. This helps you have one message to communicate to your employees.

- Manage your energy. Pay attention to how you are feeling and do what is most difficult when you have the most energy.

- Test IT infrastructure to make sure it can handle more people working from home in case you need to take this approach.

- Develop employee communication plans in case a location has an infection or a community has a lock down.

- Communicate your policy regarding health status and compensation to others in the organization. This includes what to do if you feel sick or have contact with people who are sick (including family), PTO, triggering events for furloughs, etc.

- Contact cleaning contractors in case you need to administer a disinfecting deep-clean.

- Develop plans and required actions at 1 month, 3 months, 6 months, and 1 year intervals.

- Contact your commercial bank/relationship manager and share your planned response to anticipated slowing of sales, production or service challenges, and supply chain disruptions.

GENERAL RESOURCES

When to Seek Care